As an estate planning comprehensive plan client, your plan includes one year of membership at the Client Care Plus level from the time of receiving your estate planning portfolio. When you get close to your first anniversary, you will get information on choosing one of these levels to ensure your plan continues to work when your family needs it most.

Client Care Essentials Membership Benefits – $97/year

- Secure Online Access to your Estate Planning Documents 24/7 – via LawConnect.

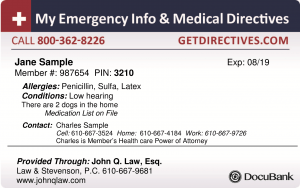

DocuBank Membership – Your Emergency Card, a plastic wallet card, lets your doctors and loved ones access your healthcare directives 24/7, anywhere in the world. Your loved ones can be by your side during a crisis, instead of searching for your legal documents. Your card also includes your medical conditions, allergies, and emergency contact information. Your Online SAFE is a secure website for storing estate planning documents and other personal files, accessible anytime, anywhere. (read more here)

DocuBank Membership – Your Emergency Card, a plastic wallet card, lets your doctors and loved ones access your healthcare directives 24/7, anywhere in the world. Your loved ones can be by your side during a crisis, instead of searching for your legal documents. Your card also includes your medical conditions, allergies, and emergency contact information. Your Online SAFE is a secure website for storing estate planning documents and other personal files, accessible anytime, anywhere. (read more here)- Admission to Events We Host – Complimentary, except for events where the fee is for a fundraiser.

- Loyalty Discount for You, Family and Friends – Typically 20%-40% off regular fees – determined at complimentary meeting.

Client Care Membership Benefits – $297/year or $25/month

- All of the Client Care Essentials Membership Benefits Above, PLUS:

- Complimentary Yourefolio Membership – A platform with a variety of estate and legacy planning modules and tools: a family album, genealogy trees, a tool to connect with your beneficiaries in a gamified way to find out what tangible assets they hope to inherit, what estate responsibilities they can do, etc.

- Complimentary 3-Year Refresh of Financial Power of Attorney – At times financial institutions are difficult to deal with if a power of attorney is more than 3-5 years old, so we’ll keep your document up to date every three years (doesn’t include substantive changes – see next page if you desire changes).

- 50% Off Incapacity Documents for College-Aged Children – As your children turn 18, they need a Financial Power of Attorney, Medical Power of Attorney & Directive, and HIPAA Release in place to ensure you (or the people they choose) can help them immediately in an emergency.

- 50% or More Off Routine Updates & Amendments – Ensure that your plan is always up to date and that all assets are appropriately accounted for as your life changes. See the Fee Schedule for Updates.

- Reduced Fee for New Jersey Deeds or Refinance Related Documents – Ensure real property you own is properly funded to your trust and complies with lender requirements.

Client Care Plus – $597/year or $50/month

- All of the Client Care Membership Benefits Above, PLUS:

- Attorney Meetings up to 2 meetings or 2 hours/year – Options: (1) Meeting with Your Loved Ones – Introduce your family or others who you have named in your plan to us, so they are familiar with our firm and can ask any questions they have. (2) Estate Plan & Asset Review – Keep your plan working the way you intend by discussing any changes in your life and assets. We’ll update you on changes in the law, review your assets, trust funding, and beneficiary designations and update your Family Wealth Inventory. (3) Family Wealth Legacy Interview – Build your Legacy Interview Library with additional interviews.

Complimentary Directive Communications Service (DCS) Membership – DCS helps you to create a list of ALL your digital accounts to ensure that (1) none of your financial assets will be lost and (2) all of your non-financial accounts will be handled as you wish. You direct whether you want each account to be maintained, memorialized, deleted, etc. After your death, together with our firm, DCS applies those directions, making handling your digital life much easier for your family. DCS does not record passwords or view sensitive information. (read more here) (if plan fee >$1000, included in complimentary first year)

Complimentary Directive Communications Service (DCS) Membership – DCS helps you to create a list of ALL your digital accounts to ensure that (1) none of your financial assets will be lost and (2) all of your non-financial accounts will be handled as you wish. You direct whether you want each account to be maintained, memorialized, deleted, etc. After your death, together with our firm, DCS applies those directions, making handling your digital life much easier for your family. DCS does not record passwords or view sensitive information. (read more here) (if plan fee >$1000, included in complimentary first year)

Note: If you choose not to renew and later choose to re-enroll, the annual rate will be that year’s membership rate. Also, we reserve the right to charge a re-enrollment fee and to preclude any benefits related to discounts on legal services.